We used the example of starting with $5000 but this can be applied to any amount really. The only important part is actually getting started as soon as possible and to not delay, not even for another week. You know as well as I do that a week can become a month can easily become a year, or even more. As Anthony Robbins said: “When is NOW the best time to start?”

#1- Open a brokerage account

The first step is perhaps the more “complicated” one as you must of course open a brokerage account. There are a variety of ways to do this but I would say that this is the #1 cause why most investors postpone opening an account. It doesn’t have to be. You can go to a broker such as Etrade and open an account. You do not need to do much. Basically fill out a few forms and then transfer money into the account. Depending on the broker, there can be a minimum amount to open the account. Once that is done, you will be able to transfer smaller amounts. If you do have $5000 free, you will generally be ok to open an account at most brokers. What you are looking for is a broker that charges little for stock execution trades (usually under 10$ is a good benchmark).

#2- Buy 2 reliable growth dividend stocks

Because commission end up being paid, you do not want to buy too many different stocks all at once. You want to avoid paying too much in commissions so a good rule of thumb is to buying a stock every time you have $2000 free in your account. Obviously, with $5000, you can buy 2. We will get more into choosing the right stocks later on in future columns but the general rule is that you want to take two stocks:

-In different sectors

-That have consistently increased their dividend payout for years

-Companies that can maintain the increases and current payouts

-Mature companies

-Etc

Every month at least, we give out some dividend picks in our free newsletter so you could get some ideas there.

#3- Set up an automatic investment plan

(start small, then increase steadily)

This is really one of the main keys. While compounding will work and you will earn dividends with the 2 stocks you just purchased, the truth is that the goal is to build passive income and you will need to put a lot more money to work. The goal here is to do so on a very consistent basis. It is all about having it automated in my opinion. The easiest way is to have a savings account (for example at ING) and then do a weekly or bi-weekly transfer from your banking account to that savings account. Start with a small amount that you know you can make.

As time goes by, you can increase this amount. For example if you get a salary increase, you could put all or most of the increase into that automatic transfer in order . If you start at 10$/week and within 1 or 2 years you get an increase that gives you 20$ more per week, you could simply put half of that into your automatic money transfer. I’m telling you, it adds up a lot quicker than you realize. The key is to:

-Start as early as possible with the transfers

-Do it automatically so it’s not a “choice” between spending or saving

-Increase the amount over time as your income increases

Once you have $2000 or so in your savings account, it is time to transfer it into your brokerage account and add to your portfolio!

#4- Reinvest those dividends (they will grow)

Following the same logic, it is important to leave all dividends received inside the account. These and the automatic contributions are what will make it possible for you to create a bigger and more diversified portfolio. The dividends will seem small, especially in the early months when they might not be big enough to pay for a good dinner. But compounding does work and it is important to keep the money inside your account.

#5- Every time you get $2000, buy new shares

It is tempting to try to time the market but when it comes to a long term investment like this portfolio, you will end up losing more if you put too much effort into timing your trades. What you want to do here is make a stock purchase every time you have $2000 available. Ideally you want to diversify into 20-30 companies across different industries, etc. We will discuss this aspect in greater detail in coming weeks but compared to a simple retirement portfolio, a dividend portfolio would have more positions because you are selecting individual companies. You do not want any one company to represent more than a small percentage of your portfolio in case it turns out to be the next Enron. There are enough good dividend portfolios to have 20 or 30 positions.

Do your research and see what investment is not only best oppotunity but also the best for your portfolio.

#6- Review portfolio at least quarterly

So you might be wondering if you should just keep buying all the time without ever selling. No, of course not. A good dividend stock might suffer a down turn, especially if the company is in decline. That is why at least quarterly you should look at every position to decide if the position should remain in your portfolio or if the conditions that warranted your purchase have changed significantly. The main things you would be looking at when doing this exercise are:

-Company revenue growth (if it’s negative… might be time to reconsider)

-Company profits (are they keeping up?)”

-Dividends payout (remember you are looking for stocks that are increasing their dividend or at least could do so in the near future)

#7- Increase the amount over time as your income increases

No explaining required. This is a key. As your income increases, be sure to put a higher amount into your portfolio, you will not even notice the difference but your portfolio will grow much faster.

(+62)85643010500

(+62)85643010500

Bahasa Indonesia

Bahasa Indonesia English

English

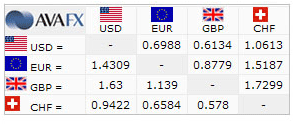

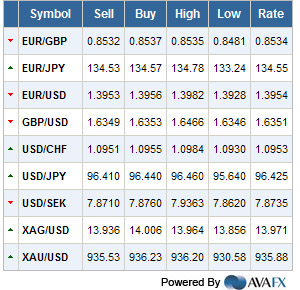

Dollar Amerika kurs asing

Dollar Amerika kurs asing

9:14:00 AM

9:14:00 AM

HYIP GARUDA

HYIP GARUDA

Posted in:

Posted in:

0.03%

0.03% -0.82%

-0.82%

IP Tracing and IP Tracking (39.215.7.172)

IP Tracing and IP Tracking (39.215.7.172)

Submit Sitemap

Submit Sitemap

LINK EXCHANGE|

Do-Follow

HOME

LINK EXCHANGE|

Do-Follow

HOME

0 komentar:

Posting Komentar